Reclaim your VAT tax quickly and reliably

Filing tax returns requires a lot of time and other internal resources. Leave this step to us and focus on what matters most - your business

Secure

Violating VAT tax regulations may result in significant financial loss. Based on the specifics of every case, we take over the reclamation process to minimize these risks.

Professional

Filing tax returns requires a lot of time and other internal resources that, if allocated correctly, could significantly boost your business efficiency. Leave this step to us and focus on what matters most.

Effective

Your case is in expert hands. Our team has a deep background in the transport sector and closely follows the newest regulatory updates to represent you with confidence and professionalism.

Why choose us?

CRT Partner - your reliable partner for VAT tax reclamation.

From document preparation to filing and correspondence with the authorities, we have you covered in every step

We understand and fulfill specific client expectations to deliver real results

We adjust tried and tested strategies to your business needs

We work to ensure a maximal return amount in every case

We empower businesses by saving time and internal resources

We ensure legal compliance of documents and help to minimize the risk of losses

Your secure fuel card for convenient payments across Europe

Your reliable partner on the road

We continuously expand our partner network and implement innovative solutions to help your business operate more efficiently and securely.

More than 5500 fuel stations designed for heavy vehicles

Real-time fuel price updates

Contactless payment options

F.A.Q.

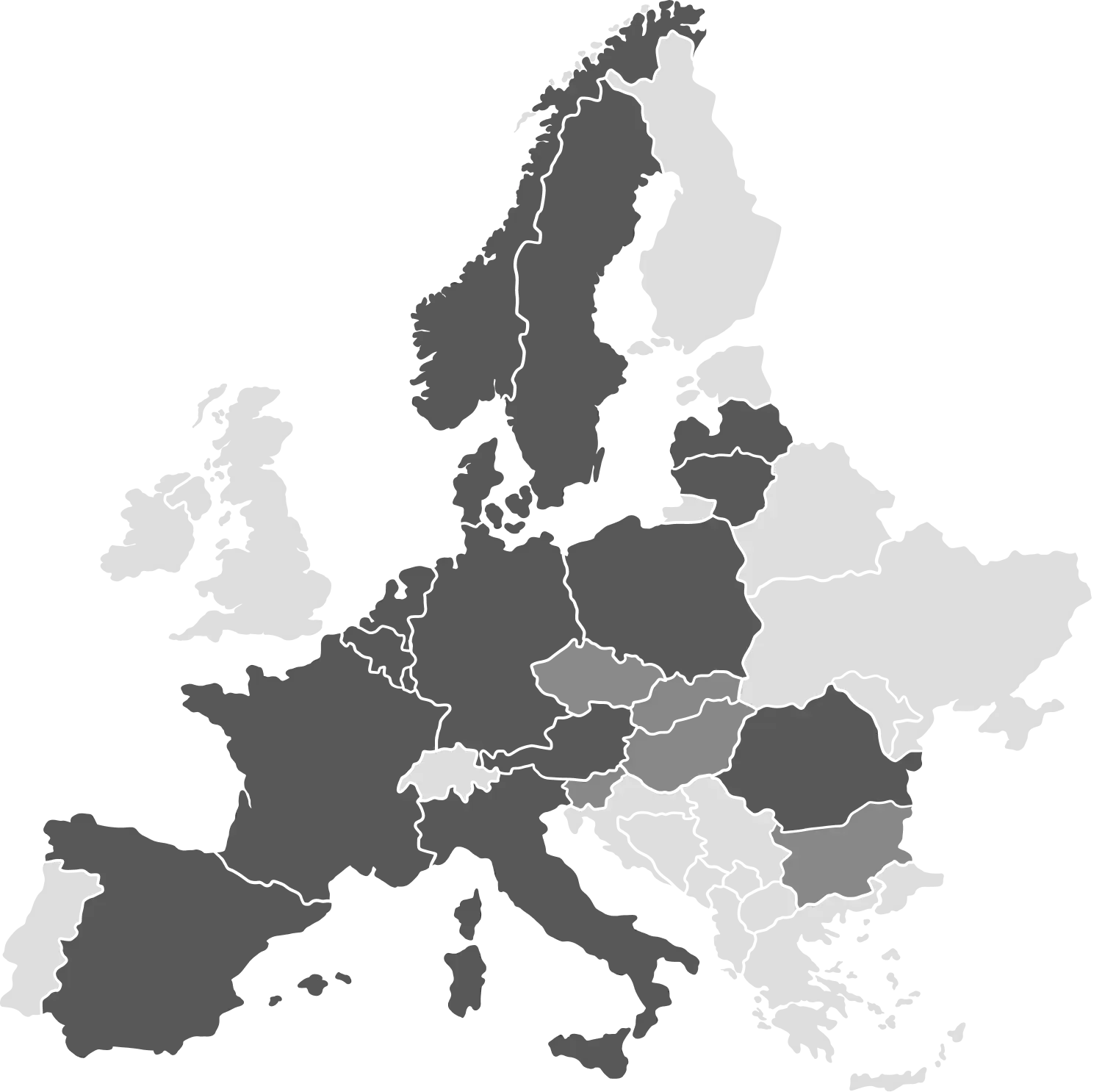

From which countries can I claim a VAT refund through CRT Partner?

We process VAT refunds from all EU countries except Switzerland, Croatia, Ireland, and the United Kingdom.

How long does a refund take after applying?

According to EU Directive 2008/9/EC, the processing time for a VAT refund application is up to 4 months. If the application requires corrections, the processing time will be extended by 2 months. The maximum processing period for an application is 8 months. In Norway, however, applications are processed within 12 months or longer.

Can I claim VAT refunds for invoices that were not issued by CRT Partner?

Yes, you can. We also assist with VAT refunds from some EU countries for receipts issued by cash registers, but only when they do not exceed a specified amount for the respective country. In all cases, it is necessary to have an invoice for the goods or services purchased.

What do I need to claim VAT from foreign countries?

You need to sign a VAT refund agreement and submit the necessary documents (in some cases, this includes vehicle rental or leasing agreements, travel logs, CMRs, DDD files, etc.).

Is a vehicle registration number mandatory on invoices?

Yes, it is mandatory.

What expenses are eligible for VAT refunds?

VAT can be refunded for fuel, AdBlue, road tolls, and parking fees in all countries. Some countries also refund VAT for vehicle repair services, hotels, car wash, and other expenses.

Company address:

Žalgirio str. 92, 1st entrance, Vilnius LT-09303, Lithuania

Company code: 302760841

Tax payer (VAT) code: LT100006825214

Swedbank, AB B/A: LT60 7300 0101 3761 3943

Bank code: 73000 SWIFT: HABALT22